Who wants to become a millionaire?

After Gameboy Color came out I remember running over to my best friend’s house to drool over hers. We took turns playing her Pokémon Blue and winning big money at Team Rocket’s casino. It took the two of us an entire week to collect enough coins in the casino to buy a Dratini.

If you have zero clues what in the heck I’m talking about, you might be too old for this post.

We perfected our casino strategy by each taking turns while the other one rested. When one of us started getting tired or “running out of luck,” we had the other one take over. We exit out of the slot machine screen then re-enter another slot machine to play. The Pokémon casino game was rigged so the algorithms for winning differed from slot to slot. When we finally landed on a high winning algorithm slot machine, we memorized the placements of each rhythm using muscle memory and bam, coins!

We spent 3 coins per spin. We made 5 to 15 coins every winning spin.

It took a week of straight up hustling to get to 9,999 coins.

If you know the awesomeness that is all the evolutionary forms of Dratini then you will understand why two baby millennials spent an entire week after school perfecting their gambling addiction strategy.

And you should definitely read the awesomeness that is the real secrets of how any millennial can someday harvest their own $1 million coins dollars.

Table of Contents

NEW KIDS ON THE BLOCK

The average millennial (those of us over 18 and under 35) made just slightly above $35,000 according to data released in 2015 1. Recently reported, about 70% of young adults are financially illiterate meaning they couldn’t answer 3 basic multiple choice questions about personal finance 2.

No judgment here, I remember those college days. More importantly, I needed to know if the boy I liked – liked me back. All brain cells were depleted on that. Before I was married to hubby, I thought I was going to be Mrs. Tang, Micheletti, or Ng.

I was never in heavy debt or anything. You don’t need to know all the complexities of money in order to be financially well off. Saving money is really easy if all wits are kept on your persons.

Majority of the hacks below are common sense.

And if you come out a bit in debt, that’s OK too. I graduated with $20,000 in student debt and I killed that sucker in 8 months. There’s so much time here for millennials to fix any money mistake. So much time.

“Life is a game of seconds.”

When I was little, my mommy said that to me a lot. I never really fully understood that line until I grew older.

The average life expectancy for a typical American is about 78 years.

We spend a good 18 of those 78 years goofing around at our parent’s house, 2 of those years pooping ourselves. The rest of the 60 years on this planet is a half youthful blunder, half work fatigue, and diapers. More and more millennials are also pursuing post-graduate education which pulls the average school exit age to the oldest it has ever been in U.S. history.

CAN YOU SPARE 30 YEARS?

I was inspired to write this post by Mustard Seed Money who wrote a breakdown of how long it would take for someone to save $1,000,000.

I went with 30 years because that is the comfortable lower end of an American’s time in the workforce from when we first start working. 30 years is also the term of most mortgages as well and we all know a huge percentage of American’s net worth is tied into the equity of their home.

BAD NEWS FIRST

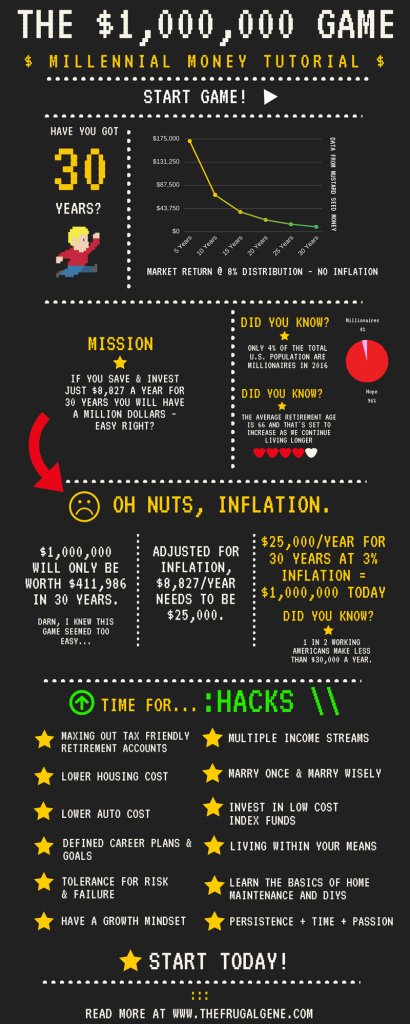

If you look at the graph at 30 years (the last row), $8,827 a year or $735.62 every month is what you need to save and invest to become a millionaire. Depending on the situation, this is either easy, ambitious or a hilarious joke that’s not even realistic.

I got some more bad news.

No inflation.

The graph doesn’t take inflation into account and in 30 years that cold $1,000,000 would only be worth $411,986 in today’s dollars.

Not even half a million worth.

Oh no, I’m not getting the bum rush. I want the real deal!

After adjusting for 3% inflation the real number to save is actually slightly over $25,000 a year. That’s $2,210 a month that you would have to keep saving and investing that amount every month, every year, for 30 years.

It’s kind of depressing huh?

More bad news:

*Did you know 1 out of 2 Americans make less than $30,000 a year?

*Did you know that according to a recent 2016 poll, only 4% of Americans are considered millionaires?

GOOD NEWS

Calm down, calm down, breathe. I have some good news too. This 1,000,000 game? It has hacks too.

Barred from an auspicious succession of rotten luck and a lifetime of misfortunes that are statistically not likely – when I mean any millennials who wants to become a millionaire can become one, I mean it.

It’s totally doable, there’s lots of wiggle room to be had even though it sounds impossible.

If you want a real $1,000,000 dollars in 30 years for that cruise or that security or just to rub in the face of the simpleton from middle school who teased you, this is what you have to do:

START GAME!

Hack #1: Max Out Retirement

You know it’s a big deal when both big government and employers alike give hefty incentives for you to save and contribute. The hefty reward can come at about $18,000+ a year even if the employer doesn’t match.

The goal is $25,000 a year right? I just took care of more than 2/3 of the goal right there! There’s only $7,000 more left to save after locking in that $18,000.

If the employer does not offer a 401K plan then go to any large bank (like Bank of America) or even better: head over to Vanguard and open up an IRA with them. The IRA contribution is only $5,500 a year but if you’re self-employed as well then you can open up a Solo 401K too while you’re there. More details on which Vanguard funds to pick in hack #009 below.

Hack #2: Lower Housing Cost

When targeting your expenses, there’s an order that you can go to. Mr. Apathy Ends addresses this in more detail. Bottom-up cost-cutting is skipping that occasional latte to save $50 a month whereas top-down is accepting a roommate to split the rent in order to save $500 a month.

I use to be a strong proponent for bottom-up cost-cutting but I’m starting to jump ship towards the top-down cost-cutting boat. I’m not saying bottom-up is useless, it’s not, but top-down can be a lot more powerful.

Housing costs can be astronomical depending on your region and place so if you are able to trim the rent, it’s certainly a rewarding way to save.

Possible reward: $100-$1,000 per month.

Wow, that was easy – if you could lower your housing cost to save $7,000 a year and max out your 401K then you’re pretty much set, future millionaire!

Hack #3: Lower Auto Cost

Everyone knows and mentions the Big 3:

*Cutting unnecessary expenses like cable. (Didn’t have one, not a billionaire. ?)

*Keeping a budget. (Dude, already know I’m broke. ?)

*Side hustling for extra money. (Yay…$40 richer and 2 hours of sleep poorer! ?)

No one mentions going car-free. Do you know how much that saves?

It shouldn’t be a big surprise I’m not a huge proponent for car ownership. If the location is competitive, it’s probably competitive because of the available urban amenities. If lowering housing cost is not possible, then killing off the car might be a better alternative.

Hubby and I use car-sharing programs like Car2Go and ReachNow that are readily available nearby. We live in a large city (Seattle) but we live in the rural outskirts of Seattle by choice because there are more trees and fewer people here.

We still make going car-free work.

Hubby and I pick up a car sometimes, do our errands and drop the car off anywhere we want to.

Last weekend, we rented a car for 1 hour for a little less than $19. This included the car rental itself, the gas, the insurance and the tax and fees too.

If we did all of our errands via the car-share program then we would need it 2-3x a week which comes out to be $80.

If we took the car out every week for 2-3x times a week for the entire month, the total then comes to $320.

CNN reports that the US average monthly gasoline amount is $368 3. $320 is less than the monthly gas consumption of an average American family with a car.

Just the gas!

We don’t have to worry about maintenance and insurance either.

I don’t want to go Money Mustachian over everybody but you know the guy’s absolutely right, right? That’s how I found MMM actually. A few years ago, I was trying to win a fight with my friend’s boyfriend who was a deadbeat but refused to give up his car. I needed someone to spit math at him faster than I could do it inside a Starbucks politely.

The car-free math is so beautiful.

Is it always easy dealing with the bus on a late evening during a rainstorm? Nope.

But it makes me feel like a little pioneer!

It makes me feel like I am fighting for frugality and that makes it more rewarding for me when the dollars come pouring through.

Related: Public bus safety tips from a lifetime expert.

Hack #4: Defined Career Goals

I think the biggest elephant in the room for a lot of millennial is simply the summary of total wage.

We’re not doing that good and it’s probably not completely our fault. For the underemployed millennials, college was more often an expensive waste of time than not. That was my mopey consensus for the first few years after my graduation.

But when you’re young, everything seems more exacerbated. It’s unlikely that wages will be stagnant if the intent to improve is there. It’s unlikely that we would continue to be in the same situation 3, 5, or 10 years down the road.

If you hate what you do for a living, find what you love to do on the side and go from there.

A celebratory jig is always deserved when a side hustle blossoms into something bigger and more rewarding.

Like talking to people?

I knew this guy from my driver’s ed class. He’s a little too nice, kind of chubby, at least 3 years older than me. After a series of addictions, he hit rock bottom but didn’t want to leave the country as a failure. He started going to credit counseling classes to get the help he needed. Fast forward a few years later, he is now working as a trained credit counselor. The fact that he was bilingual made him very employable. He loves talking to people and his passion to help others gave him a great rapport in the community

If you like writing start looking at side hustles that exercise your writing skills.

“There’s nothing near me”

Can we drop this mindset? It’s never, ever that easy. There’s definitely not going to be any nearby statistically speaking. The world is a messy, extemporaneous place. I went through an entire bucket list of side hustles before I settled on this blogging thing.

Like shopping?

There are flippers out there who make a killing off flipping items. They spend $30 at a thrift store and flip it for $60. Minus the shipping and fees, that’s a cold hard $20 in the pocket. Plus there’s no limit to how much you can sell.

Hack #5: Tolerance for Failure and Risk

Have you ever seen your net worth or debt progress drop? Not fun.

I stink at this hack. I was so bad at accepting failure and taking risks, I stayed in a doomed relationship with Mr. Executive because either of us could accept failure.

This is the same application as finance. I still have trouble with this – and it’s OK. I have to pull back and rethink my failures as lessons.

“You taste the bitterness first, and you will gain the sweetness for the rest of your life.”

Hack #6: Have a Growth Mindset

I touched on this in hack #004. A lot of our personal limitation is self-imposed. It sounds so corny but it’s true!

I am the best convert to obtaining my growth mindset from my fixed mindset.

Do you know what I was as a teenager?

The goth kid.

I grew out of it (but not the music, the metal is still divine.)

Hack #7: Create Multiple Income Streams

When I was a college sophomore I used to browse Reddit, in the lecture hall of course, where all responsible Redditing should occur. I read this crazy headline in /r/TIL saying the average millionaire has 7 streams of income.

Young me didn’t even click on that headline because young me thought that had to be clickbait.

I was like – wow millionaires must never sleep because they have to work 7 jobs…I was so naïve, it’s like…embarrassing now.

Multiple streams of income can be anything from rent, dividends, selling t-shirts online, regular 9 to 5 etc.

If you make under $30,000, first on the to-do list is increasing income. There’s not much fat to trim hovering around minimum wage.

Hack #8: Marry Once & Marry Wisely

We may not be able to choose who we fall in love with but there are safeguards to mitigate some risks. Finding Mr/Mrs. Right is tough. People can change and life throws curve balls. If one party has enough assets and the other party has had a long history of debt, the practical advice is prenuptial legal agreement. I’m not a romantic so it sounds like I’m talking about protection against sexually transmitted disease but it’s still good advice 🙂

Hack #9: Invest in Low-Cost Index Funds

The biggest secret to wealth is investing it wisely. I don’t care how hardcore of a saver you are, that’s only half the battle. What else is going to fight inflation and take advantage of the great benefit of compounding?

Investing is not hard, there’s only 3 tickers you need to know (assuming your age and risk tolerance is like ours):

VTSMX, VGTSX and VBMFX. Mama Fish has the skinny on these magical creatures.

In addition (this is not investment advice for you – I’m just sharing), what me and Hubby does is diversify with high yield and REITs. We only put the high yield and international REITs into our Roth IRAs.

Hack #10: Live Within Your Means

Track the expenses of your life with diligence and strategic planning. Learning to budget is not something that comes naturally to anyone. I don’t know why it’s not as highly valued as learning other things – if there’s driver education in high school then there should be a class on how to balance a budget. Is that why we’re so car crazy? Omg, conspiracy!

Hack #11: Find Multiple Sources of Income

Active income and passive income are ways to boost your income and save more money.

⭐ Related Reads:

- All You Need to Know About Becoming an Amazon Flex Driver (Starting $18 to $30/hr)

- 7+ Companies That Will Pay You To Lose Weight (Really!)

- How To Work From Home Creating a Profitable Doggy Day Care

Hack #12: Persistence, Time, and passion

Persistence, time and the passion of pursuit is like nacho cheese…it goes good with everything ?.

Sidebar: I added some nacho cheese into my ramen during my month of hell…everybody…it’s the most delicious thing ever (for under a $1). It’s so

radioactiveyummy!!!

Hack #13: Start TODAY!!!

The Soap Argument: “30 years is too long, pssh girl I can’t even right now…let me just get through the month.”

Yep, it is! It’s really long.

30 years equals 360 weeks which equals 10,950 days which means that’ll be 262,800 hours and that comes to a grand total of 15,778,463 minutes.

You know what else?

It. Doesn’t. Matter.

I’ve yet to witness time standing still. The passage of time is all we can depend on. That and the natural course of human life. Chances are you will live beyond expectation thanks to the leaps and bounds we have made in medical science 4. Chances are you will have a fruitful life and march into your golden years with all kidneys and lungs intact. Congratulations in advance to all the fat and healthy grandbabies that will be fighting over who gets to hang off your walker.

The passage of time is inevitable.

It’s not “oh, I have 30 years to start” it’s more like “I have 30 years to make sure my granny bum is covered and covered well.”

- https://smartasset.com/retirement/the-average-salary-of-a-millennial

- https://www.cnbc.com/2017/02/14/millennials-arent-as-smart-about-money-as-they-think.html

- http://money.cnn.com/2011/05/05/news/economy/gas_prices_income_spending/index.htm

- http://www.nola.com/health/index.ssf/2011/11/americans_reaching_age_90_more.html

Lily, you always crack me up!!

Man, I can’t tell you how many ways we’ve run our numbers to see how early we can retire. Growing up, I never thought about retirement, but since I took your marry once and stay married life hack, I have definitely thought more since he came into the picture.

We dream of early retirement, with years of flexible lifestyle before that. We know it’s in our future, but we definitely have to incorporate alot of those life hacks you mentioned.

Can’t wait to hear you and Ms. FAF on that podcast soon!

Did you like the podcast? Let’s gab on Twitter and feel free to ask me any blog Qs there. Add me and Ms. FAF to a group convo, she knows a bunch too!

Such a detailed post, Lily. I love it! I wish schools would make personal finance a mandatory course. Most people don’t realize the power of time and compounding. You don’t have to do anything fancy. Good ol’ time and persistence can get you to your goals.

Thanks Tina!! It takes a lot of time but time is inevitable so it’s better to start now than later 🙂

I still have a Gameboy color, and still play Tetris sometimes! (Circa 1987 – I’m too old for Pokemon.)

Great post and I love the focus on inflation. So many people ignore that but it is a HUGE part of financial calculations.

I was helping someone recently determine if they were on-track with saving for their kids’ college. Inflation rates can have drastic impact on the plan. Especially since college cost inflation is running twice normal consumer inflation. :-(((

Wowwww I didn’t know that tidbit! Twice the rate >_> I don’t even…good lord, how did higher ed become so money grubby?

LOVED this! I love your analysis on the impact of investing now for the future. It’s clear that investing while you’re young is an investors most powerful tool. Also – if people can find a way to get rid of their car and house hack to save money, they will have a lot easier time investing!

Thanks Lance ?

This is a refreshing take on the road to becoming a millionaire.

I love that all the details are simplified so anyone can see what it truly takes to become a millionaire.

I think the last tip should be to play the game for life. There’s no point in practicing financial independence sometimes then return to your old spending habits.

Instead you should carefully set a financial plan for your life and execute it every day with financial hacks you’ve discovered like the ones in this post.

I loved the graphic at the start of the post Lily! It brought me back to my childhood days playing games like Pacman, hahaha.

Lol! Thanks Cory! “Play the game for life” is a brilliant tip, I wish I added that in. Consistency in financial matters is just as important as starting!

Yaaaas. Also, shoutout from a fellow Pokemon trainer! 😉 I actually miiiight be playing Pokemon Black 2 right now…

But yes! One of the best ways to get on the FIRE train is to cut the hell out of all of your expenses–both the small recurring expenses and big one-time expenses like housing.

LOL! The graphics on Black/White just light years away the original Gameboy colors. I was blow away when I saw there’s night and day differences.

Hilarious (but super informative). Do tell about your decision to park REITs etc. in your Roth IRA. Buy and hold strategy? A tax advantage? What’s your reasoning? Thanks Lily!

I remember reading somewhere (Common Sense on Mutual Funds) that some REITs comes with extra taxes so parking it in a Roth was better but my husband doesn’t think it’s the case with Vanguard’s fund. Well, it’s in there already and I’m not touching it ;p

Wow this is such a great post! Detailed and to the point! I didn’t think about becoming a millionaire until I joined the PF blogger community. You’ve laid out such a great road map to achieve the millionaire status!

Yo, 3,000 words hun! Pffft hahaha :p

I spent WAY too many hours on my Gameboy playing Pokemon back in the day. My fav. characters were Gengar, Alakazam, and Dragonite – they were also the best fighters on my squad.

This is a really excellent post and resource, Lily. I have so many thoughts in my head after reading this that I will likely have to come back to comment again with a more concise response. From a high level, just thinking about a rough number each month to save to achieve your retirement number is a thought that few people consider. It is so important to get started as early as possible, and if you develop a plan early on you will be so far ahead of everyone else!

Thank you Taylor! Come back anytime haha ?

I had Alakazam and Dragonite on my team too and they were both super fighters – Gengar evolved only through trading so I never had one 🙁 Ninetales and Gengar were both my favorite Pokemon in the first generation.

Hey Lily, great post =) was just listening to you and Ms. FAF’s podcast debut. I’m enjoying it. Haven’t finished it yet but I’m planning to later at night when I get back from work. I think out of your list, if I had to choose one, I’d say that having a growth mindset is the most important. A fixed mindset is…fixed. With a growth mindset, practically anything is achievable. I believe it strongly, and it’s one of things that have impacted my own life tremendously as well!

I just got sick of myself one day that I realized I had to change. Fixed is…fixed, just like you said. It’s the one big thing that’s impacted my life a lot as well! Twinning!! ?

Thank you for the shout out!

Tons of great advice in this post, my favorite being creating multiple income streams. Probably the most difficult one, but one that gives you so many options.

Satan

*Squeeee* Thanks Satan!!! ✨⚡️?

You provided a solid list of hacks that will help young people reach the $1M mark. My favorite one is to start now. Based on the saving figures that Mr Money Seed Money provided, it takes time and a great amount of savings. Don’t get overwhelmed. Save and invest as much as you can. You will be able to save more as your earnings grow with time.

“Don’t get overwhelmed. Save and invest as much as you can. You will be able to save more as your earnings grow with time.”

I really like that Dave! It’s absolutely true!

That graphic is EPIC, as is this post. Loved it.

That graphic is freaking AWESOME. How does one do that?

Great outline on how to be a baller one day, although I’m sure some people will fight you on the maxing out your retirement account thing. I myself wasn’t able to do that until I hit a certain income level.

My favorite tip is marrying the right person once. I think too many people leave marriage and romance to chance. If it’s something that affects you for the rest of your life, how come we don’t plan/strategize for it the same way as everything else?

I used Canva and chose the Infograph option. I love making infographs – it’s basically my outline for the post haha.

I was thinking the same thing Luxe, it’s super easy money if your employer has a 401K plan (and match) and there’s $18K to spare. But if you’re at $30K/year then that’s 60% of the your gross! I think that’s the hardest place to be because then you’re overqualified for aid but not by enough.

That was a hilarious post and nice job on the hacks! Love the infographic…

Hehe thank you ?

Good advice on here Lily! I think the one that stands out for me is living within your means. Many do not want to deal with budgeting and think its a hassle to find out your limit on spending and just believe debt will be hovering over them for most of their lives. You have to know budgeting will go a long ways because not your living within your means but also it will help you save, invest and not worry down the line about being in debt and instead of building your wealth.

I should just copy pasta this in there har har :p thanks Kris!!!

Love this post : ) Lots of great advice, and a lot of things I think people will do well to hear, even if they’re already doing them. A bit of validation can go a long way in motivating you to keep going!

( I remember Polygon being the ridiculously difficult dude to get from the casino – I remember my Dad coming into my room at one point and asking what I was doing for so long and if everything was okay 😛 )

Lol! Yessss, my friends and I won enough coins for one but we had no idea what it was. The cartoon episode was banned everywhere for giving sezuires to kids ??

Hack #13 should be #1 and be repeated every other step after. It can be so hard to comprehend the journey from $0 to $1,000,000 that just starting can often be the hardest part. Once the ball starts rolling though the saving becomes infectious.

I am going to redo that graphic Derek because that’s a great idea!!!

I must have missed this post when you initially published it but I just saw the infographic and I love it so much. We just got one of those SNES Classics and so I’m all about old video games right now!

I’m still waiting for it to go viral on Pinterest T_T! 🙂

I’m 28, started saving a year ago, I’ll plan to save around 10k per year but I still feel like I started too late. Anyway, markets will hopefully crash soon and then there will be some great opportunities of this decade. Patience is the key (unfortunately :D)

Don’t tell anyone but I’m hoping for a dip too. Buying overpriced for too long isn’t good for anyone in the long run. $10K is a great start! Keep going!